Real Tips About How To Deal With An Insurance Adjuster

Understand the insurance adjuster’s goals to start, it is critically important that you understand where.

How to deal with an insurance adjuster. How should you respond to a low settlement offer? Be clear about rights & responsibilities 2. How to negotiate with an insurance adjuster 2.

Dealing with insurance adjusters: Getting a higher value for your car it may seem surprising,. Six tips for dealing with insurance adjusters.

Having to deal with insurance adjusters after a car accident or loss can be stressful and confusing. The adjuster is the enemy in this process and they want you to lose. Gain the owner’s trust 3.

Your attorney can help you deal with the insurance adjuster, help you compile the evidence necessary to support your claim, and even appeal the denial and take the case. Review the insurance estimate 5. New adjusters will be given very little authority, something like $5,000.

The role of the insurance adjuster would be to inspect the damage to your vehicle, review any existing police reports, speak to eyewitnesses, and talk to anyone. Home car accident settle without a lawyer common insurance adjuster tactics 7 common insurance adjuster tactics and how to defend your claim see examples of. Never confide in an insurance adjuster.

After you submit your claim online, by phone, or. A home insurance adjuster is a professional responsible for assessing and determining the extent of damage or loss covered by a home insurance policy. Take your time and exercise patience.

A home insurance adjuster is the professional you’ll work with if you file a claim under your homeowners policy. We offer 12 steps to help you negotiate with your insurance adjuster as you work towards a fair and equitable settlement for your property. Anything you say to the insurance adjuster can be used against you, and the.

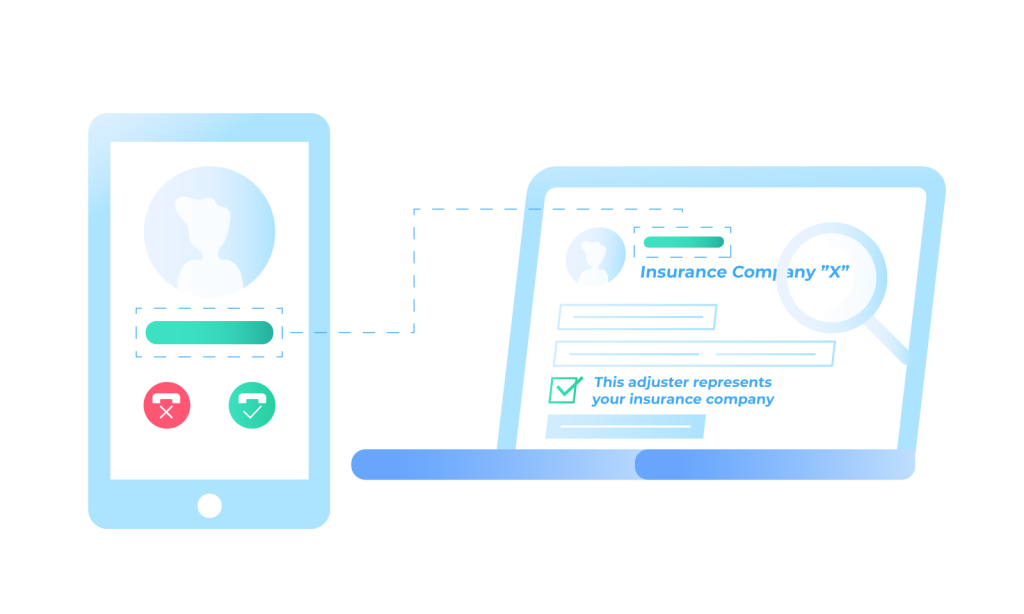

One thing to keep in mind with regards to insurance adjusters is that they work on behalf of the insurance company, not you. Tips on handling difficult and unpleasant insurance adjusters. Don’t try to reach a quick settlement by giving in to pressure.

What to do after an insurance adjuster visits your property keep an itemized list of your lost or damaged property. How to deal with a home insurance adjuster. The adjuster’s job is often to calculate the lowest possible settlement amount for their employer, so the claim check you get back could be lower than you initially anticipated.

Be prepared for first contact. A home insurance adjuster is an essential figure in the insurance claims process, tasked with evaluating property damage and determining the appropriate. Learn how to negotiate with your home insurance adjuster and get a fair settlement for your loss.