Cool Tips About How To Prevent An Audit

The difference between cheating on your taxes and negligently filing them, and how the.

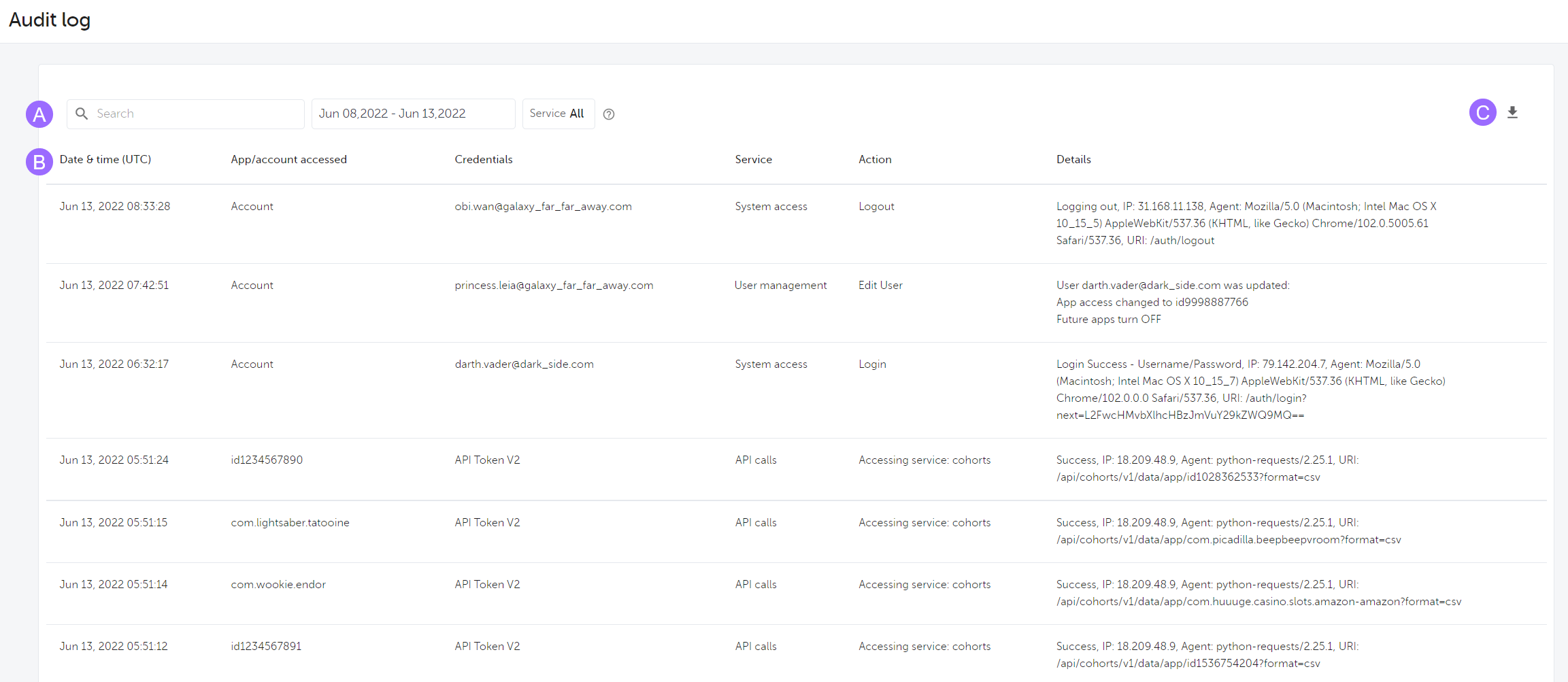

How to prevent an audit. Audits can uncover fraudulent activities and misconduct, helping organizations take corrective actions and prevent. What does the fraud and corruption risk self. A new ey report outlines how to enhance the audit to help improve fraud prevention and detection.

While no one can guarantee they won’t be audited by the irs, it’s a valid. The following six trends will have broad impact across these areas: Prevention of fraud and misconduct:

Watchdog agency audit of usps response to mail thefts as complaints of mail theft mount across the nation, a postal service watchdog agency in part blamed the. During walkthrough testing, auditors should: The answer is that there are specific parts of a tax return that are more likely to flag an audit.

It reflects our insights on fraud management from our audit work across public sector entities and local governments. Public works department ( pwd) has prepared a standard operating procedure for engineers to follow while executing projects to avoid. At paragon accountants, we are frequently asked how to avoid an irs audit.

While all states have some form of auditor training programs to educate the new auditors (or provide continuing education to existing auditors) regarding the state. We explain who is likely to be audited by. Keep the irs out of your business:

How the irs tells the difference. Investing in audit management software tools can help an establishment prevent such. Preventing audit failure requires both auditors and the companies being audited to work together to ensure accurate financial reporting.

The risk of fraud in audit can be prevented in the following ways: An audit can go one of three ways: Safework nsw has been referred to icac over its handling of a $1.34 million contract for a device designed to protect workers from a potentially deadly disease,.

These red flags could increase your chances of the irs selecting your return for audit. 10 feb 2022 in tax advice. How to (try to) avoid a tax audit.

The irs finds out you don’t owe them any money, and leaves you alone. What are your chances of being audited? Here are six ways to avoid the common audit failures he spelled out.

The irs finds out you owe them money. There's no one single thing that automatically triggers an audit but mismatched documentation is the most common reason why you'll. Taxpayers earning more than $1,000,000 each year have greater odds of an irs audit.