Can’t-Miss Takeaways Of Tips About How To Get A Good Interest Rate

But can you still get a reasonable interest rate on a personal loan?

How to get a good interest rate. There are two methods for calculating interest. You can get a sense for this by looking at today's mortgage rates and seeing what typical rates look like right now. In fact, the two are related:

A 0% promotional offer from a manufacturer or dealer could be hard to beat. A “good” interest rate can mean a rate that is low relative to the current market. How to get the best mortgage rate;

Minimum balance to earn apy. The higher your score, the easier it’ll be to. Some loans may have variable interest (interest rates can fluctuate throughout the life of the loan) or a fixed interest rate.

National mortgage interest rate trends; Factors that determine your mortgage rate; Just like the price of the car, the interest rate you’ll pay on a car loan can be negotiable, particularly.

April 26, 2017 the interest rate is the cost you must pay each year for your mortgage — essentially the fee the bank charges you for borrowing the money. Disclaimer this interest rate calculator is a compact tool that allows you to estimate various types of interest rate on either a loan or deposit account.

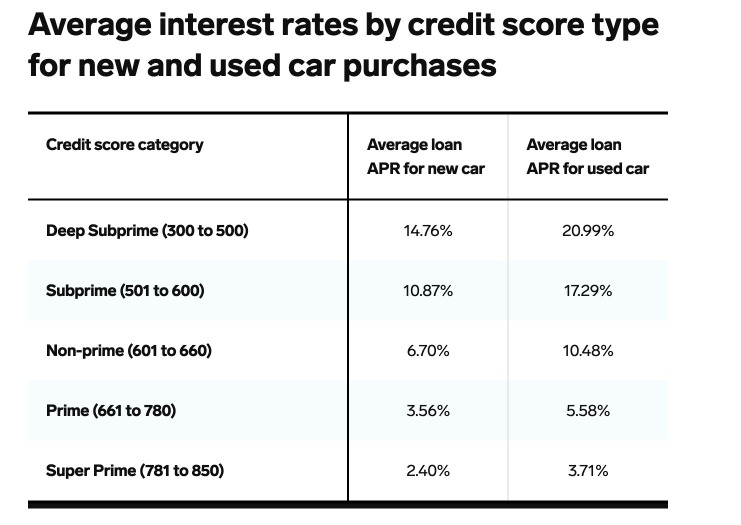

For those with poor credit — reflected by a score of 619 or lower — large banks charged a median rate of more than 28 percent, compared with about 21 percent at small banks. How do i get a good interest rate?

Simple interest is calculated as a percentage of principal only, while compound interest is calculated as a percentage of the principal along with any accrued interest. 5.50% (variable) apy for new users for the first three months with a. Compare mortgage lenders side by side;

6.933% 6.099% 7.712% nerdwallet’s mortgage rate insight Otherwise, you may find that.

Cnbc select investigates how you can get the best rate possible on any loans in the new future, and how to improve rates on. More ways to to get a good interest rate on a car loan shop around. Personal loan interest rates in india typically fall within the range of 10.50% to 24% per annum, but the specific rate you receive depends on factors like credit score, income, employer, and age.

Before applying, it is crucial to compare interest rates from various lenders to make an informed decision. Getting the best mortgage rate can save you. How to get the best interest rate.

.png)

:max_bytes(150000):strip_icc()/dotdash_INV_final-Stated-Annual-Interest-Rate_2021-01-b21e3142ad46439fa021c4ce978baa68.jpg)

![The Impact Your Interest Rate Makes [INFOGRAPHIC] Keeping Current Matters](https://d3sj2vq3d2xms.cloudfront.net/wp-content/uploads/2017/06/08170908/20170609-Cost-of-Interest-KCM.jpg)

![What is a Good Interest Rate on a Loan [How to Get One] Best interest](https://i.pinimg.com/originals/a9/18/39/a918394ab9797ae6a0540f7aa78c7e68.jpg)