Inspirating Info About How To Claim Rental Property

To take a deduction for depreciation on a rental property, the property must meet specific criteria.

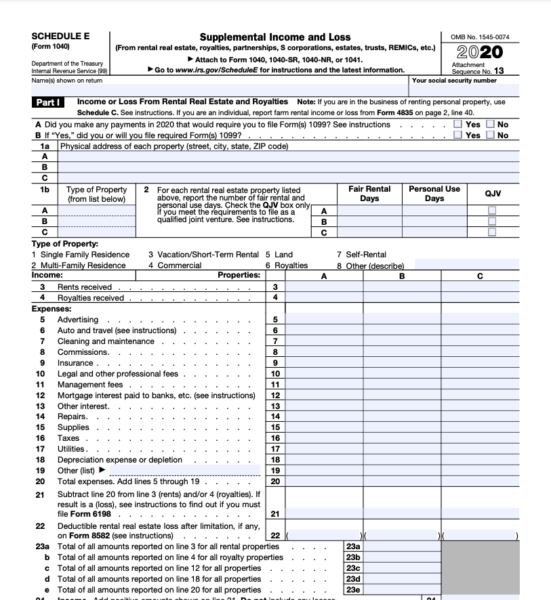

How to claim rental property. That means that if you use the. Rental expenses to claim rental expense categories. List your total income, expenses, and depreciation for each rental property on the appropriate line of schedule e.

See the instructions for form 4562. Property taxes are an ongoing expense for rental property owners. The irs allows you to deduct a specific amount (typically 3.636%) from your taxable income every full year you own and rent a property.

By ryan bembridge. Homeowners can deduct up to a total of $10,000 ($5,000 if married filing separately) for. It's possible that you'll use more than one dwelling unit as a residence during the year.

Rental property depreciation allows property owners to write off the costs of purchasing and improving rental property on their income tax returns. If you hold a share in a rented residential. To properly claim tax deductions for rental properties:

Gather all the necessary information, which includes your rental income records for the year, records of all your. Complete irs schedule d. Written lease and legal forms, pens and paper, and printer ink are expenses many property owners incur that are fully tax deductible.

You must own the property, not be renting. This flows through to the first page of form. The relief is available to individual landlords of rented residential premises.

In this post, we’ll go over the basics of deducting remodeling expenses for rental property owners. It is not available to companies, trusts or estates. The short answer is yes, but there are a few things to keep in mind.

How do i report my rental income? Before we discuss joint ownership of rental property income, let’s take a quick look at how to calculate income from a rental property. Report all rental income on schedule e of irs form 1040.

The only difference is that you rent a mobile home. A property owner can claim depreciation on rental property as long as they own the property and generate rental income from it. Home office tax deduction.

You can generally use schedule e for supplemental income and loss to report income and expenses related to real estate rentals. There may be some expenses you can claim a deduction for prior to the property being. Cash or the fair market value of property or services you receive for the use of real estate or personal property is.