Unbelievable Info About How To Claim Paye

This documentation is proof you’ve.

How to claim paye. Forms used by employers assistance for employers overview as an employer you will have to deduct the following from your employees' gross pay: If you are a pay as you earn (paye) taxpayer, you must complete a paye income tax return to: Follow the easy steps below to register for paye on efiling.

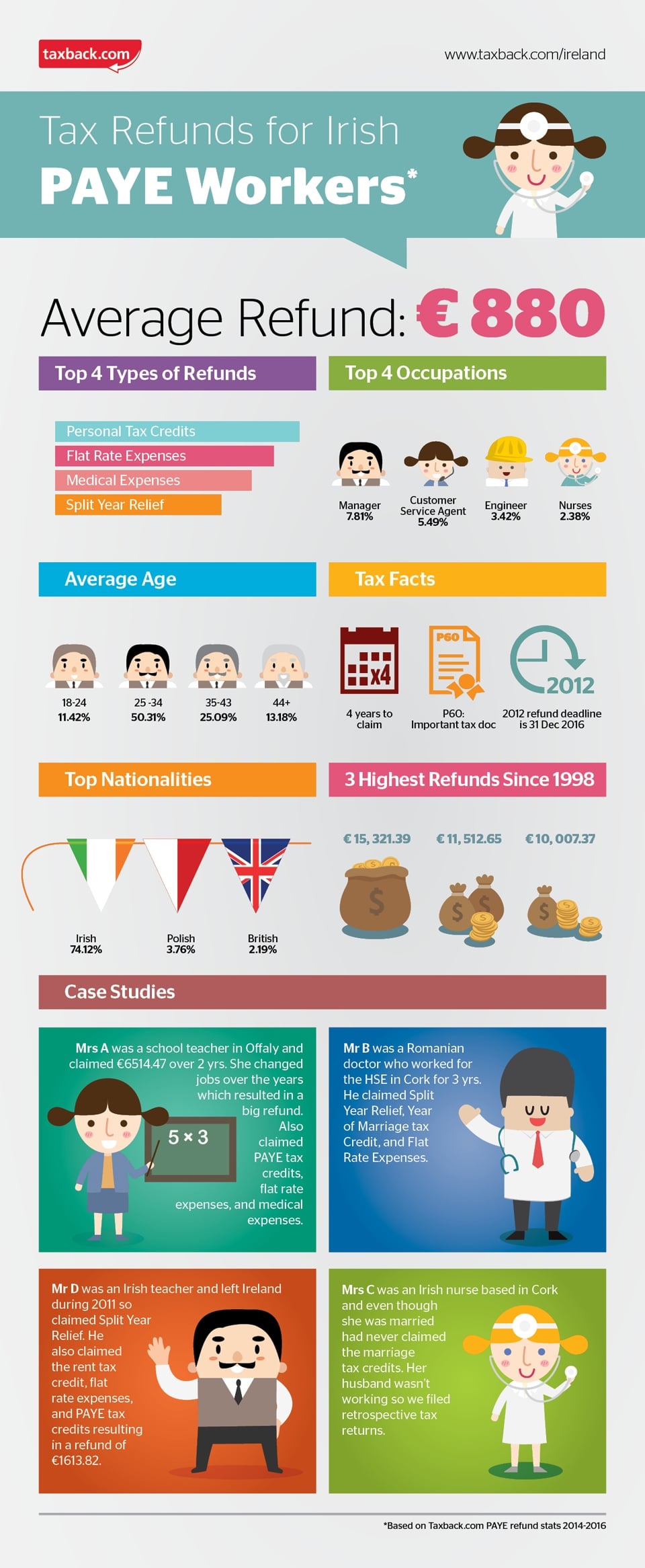

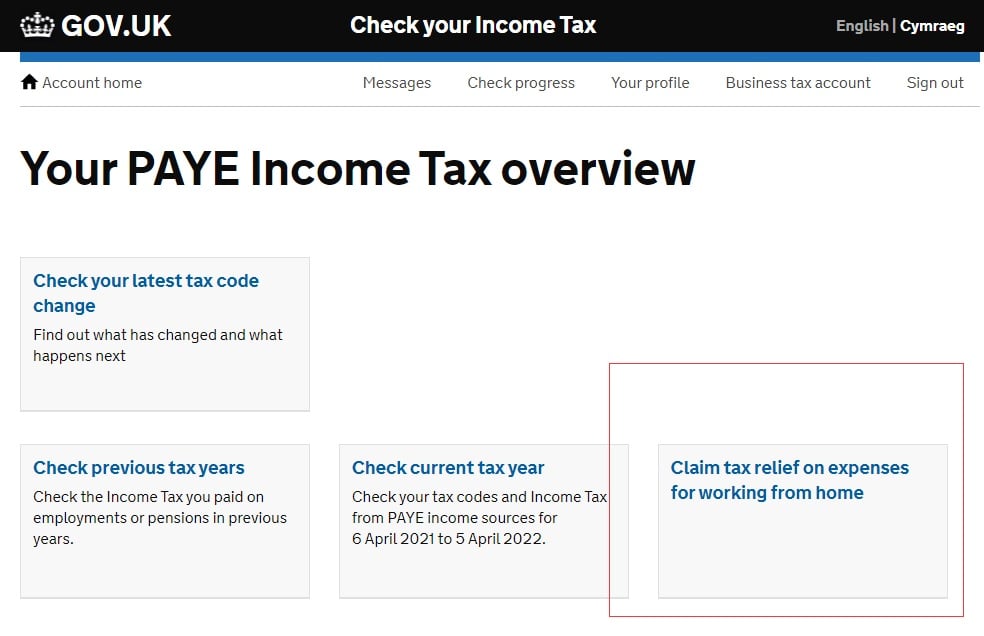

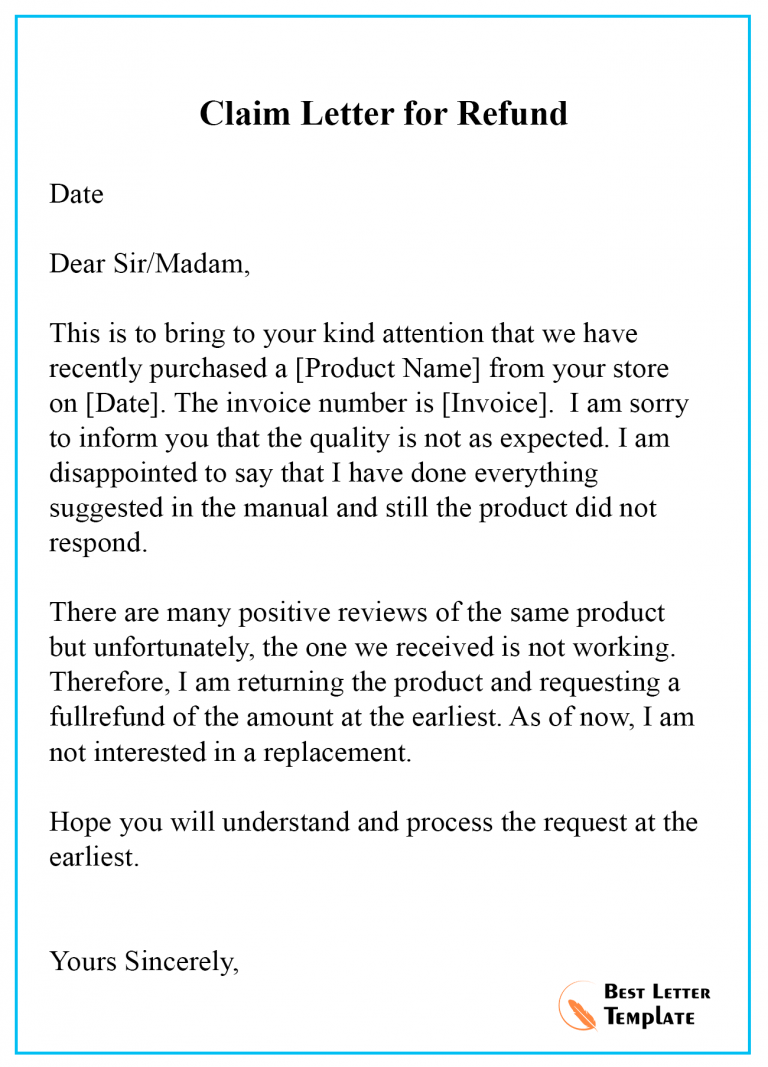

For taxpayers who want to make a claim, the quickest, easiest and most convenient way to do so is online using paye services, which is available in revenue's. Check how to claim a tax refund. Claim additional tax credits, reliefs or expenses declare additional.

Guide for employers in respect of revision: Use this tool to find out what you need to do if you paid too much on: How to claim tax back from sars.

The full story. Change healthcare, a health care technology company that is part of optum and owned by unitedhealth group, continues to experience a cyberattack. Paye, which stands for pay as you earn, is a system implemented by the south african revenue service (sars) to collect income tax from employees.

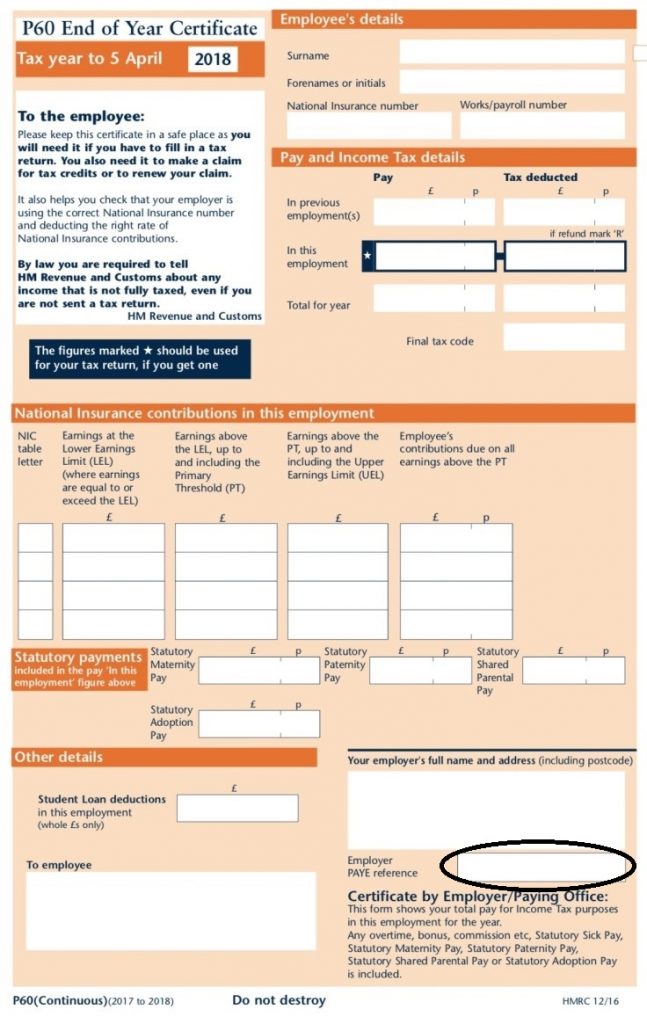

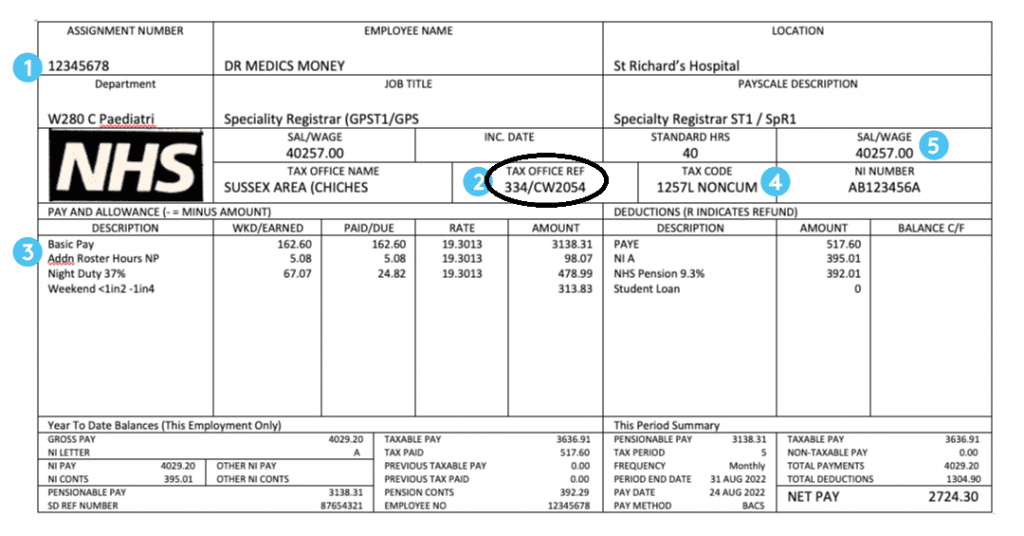

This will give providers better. To claim your paye tax refund online, you’ll need your employer’s paye reference number, which can be found on your p60, and any details on the taxable benefits and. Epic’s payer platform is being integrated with highmark’s claims data on google cloud, the companies announced monday at vive.

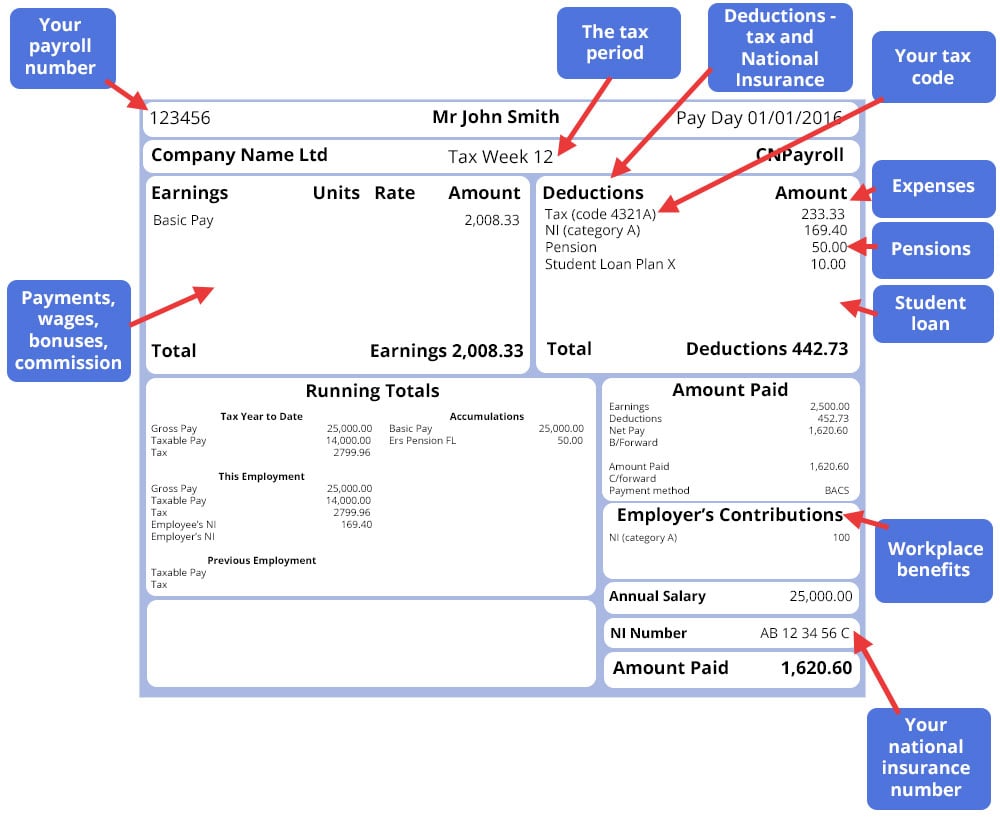

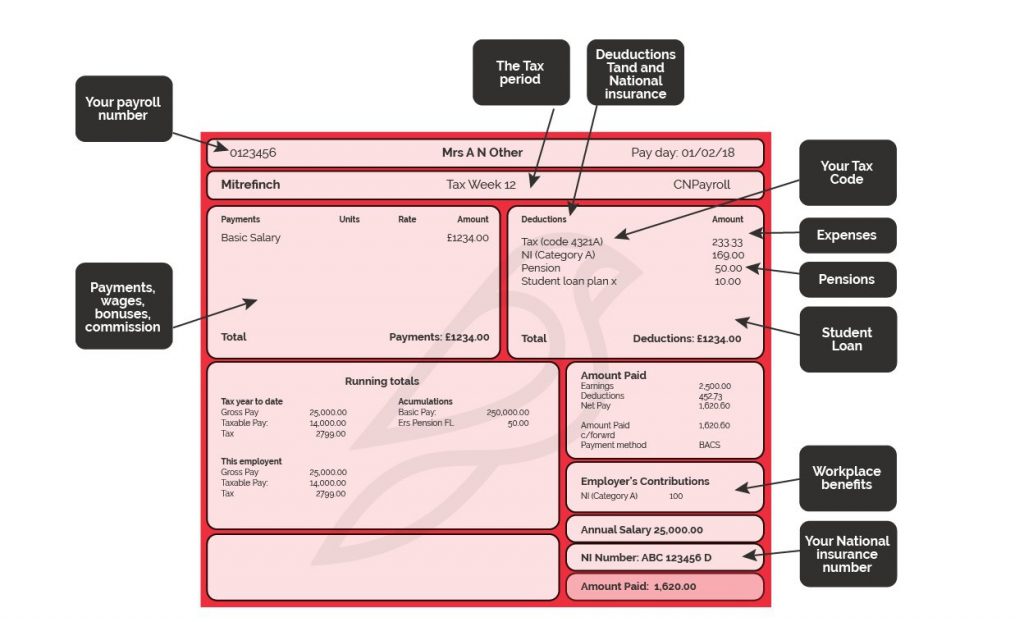

You may be able to get a tax refund (rebate) if you’ve paid too much tax. You cannot claim for any work carried out or paid for after 31. Paye, or pay as you earn, is the payroll system used in the united kingdom to collect income tax from employees who earn a salary.

Pharmacies across the united states are experiencing disruptions following a hack at unitedhealth's technology unit, change healthcare, several pharmacy chains. The percentage is reduced to 20% if the employer is satisfied that at least 80% of the use of the motor vehicle for the tax year will be for business purposes. Pharmacies across the united states are reporting that they are having difficulty getting prescriptions to patients because of a cyberattack on a unit of unitedhealth.

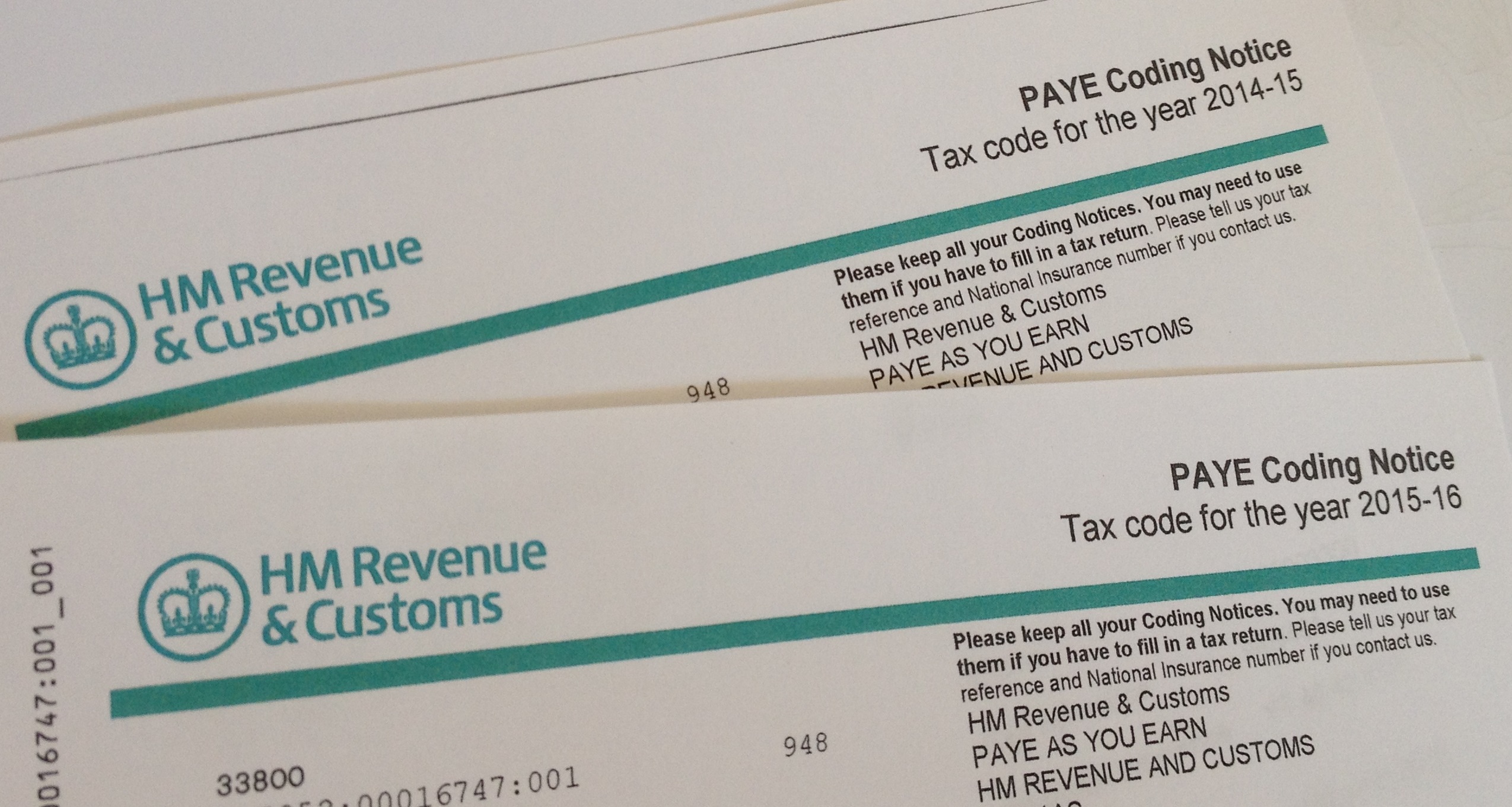

Step 1 logon to efiling step 2 navigate to sars registered details functionality: How to apply contact introduction if you have tax deducted from your income by your employer, you are a paye taxpayer. Pay as you earn (paye) workers whose income now exceed the previous tax threshold of $592,800, but who earn up to $796,536 are to receive a.

The amounts deducted or withheld by the employer must be paid to the south african revenue service (sars) on a monthly basis, by completing the monthly. Once this is completed, you can claim 13.5% of the cost of the work back in your taxes over a period of two years. Employers seeking a refund for a paye overpayment in a previous tax year need to make a claim, either by calling the employer helpline on 0300 200 3200 or.

You can use revenue's myaccount service to. On the individual portfolio, select home to find the sars registered details functionality on the tax. In this blog post, we will.