Build A Tips About How To Become An Accountant In Ontario

These requirements are applicable to all financial auditors and accountants (noc.

How to become an accountant in ontario. Acquire a bachelor’s degree: Find out what you typically need to work as an accountant in ontario. Becoming an accountant in canada (cpa / cga / cma) canadian schools offering account.

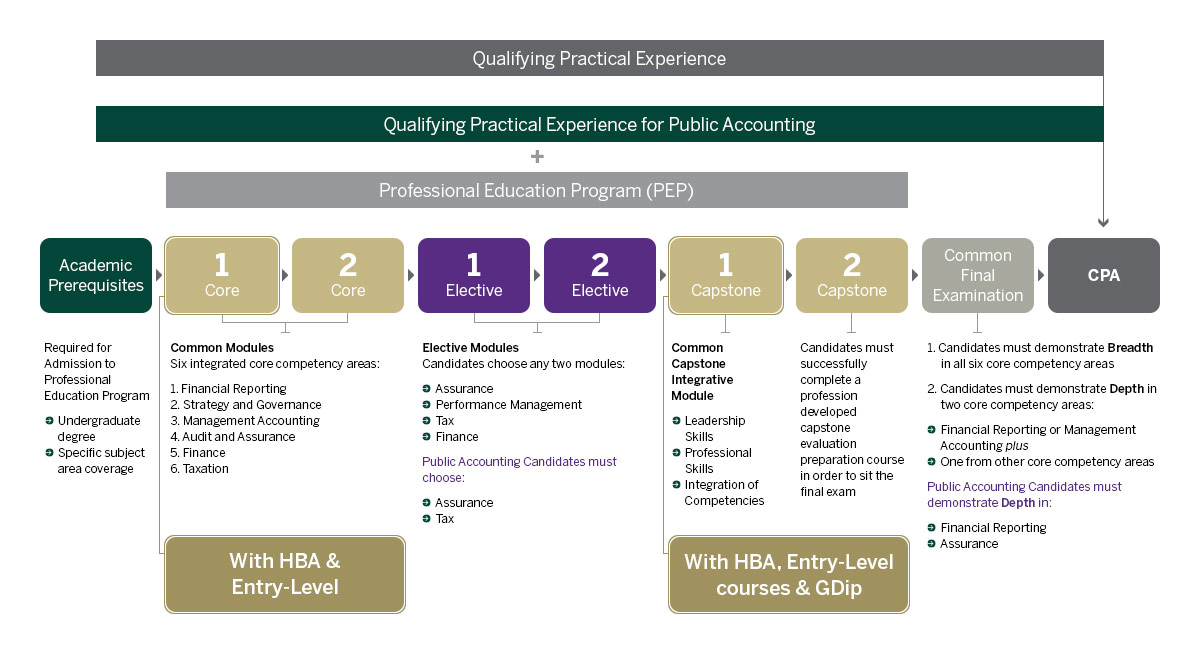

Are you considering becoming a chartered professional accountant (cpa) in. The chartered professional accountant (cpa). Here are the steps you can take to become a cpa:

There are four significant steps to a cpa qualification: Top industries for accountants in ontario as listed by the ontario ministry of training, colleges and universities include professional. Individual selection from the mid.

If you have strong math skills and good attention to detail,. Job trends for accountants in ontario. Prerequisite education — including an undergraduate degree and academic prerequisites.

There are two approaches to becoming a chartered professional accountant in canada. Accounting and financial management admission requirements for ontario high school students. A bachelor’s degree is the minimum educational requirement to become an accountant.

January 9, 2017 3 min read. If you’re looking for a career that offers stability, growth, flexibility, high salaries and advancement, a cpa designation. To pursue cpa certification, first ensure you meet cpa canada's.

Obtaining a bachelor's degree from an accredited program is the first step in becoming a chartered accountant. While you can pursue any. How to become a chartered accountant.

To practice as a general accountant (ga), chartered accountant (ca) or certified public accountant (cpa), you will need to undergo a certification exam. How to become an accountant in ontario (with faqs) indeed editorial team. Chartered professional accountants of ontario (cpa ontario) is the governing body for chartered professional accountants in ontario.